Why Banks Need to Worry About Crypto Again

After a decade of mutual suspicion, traditional finance and crypto are converging. Stablecoins reached $33T in volume, major banks have embraced blockchain, and DeFi is quietly building the rails that will reshape lending and payments. A banker's perspective on what's next.

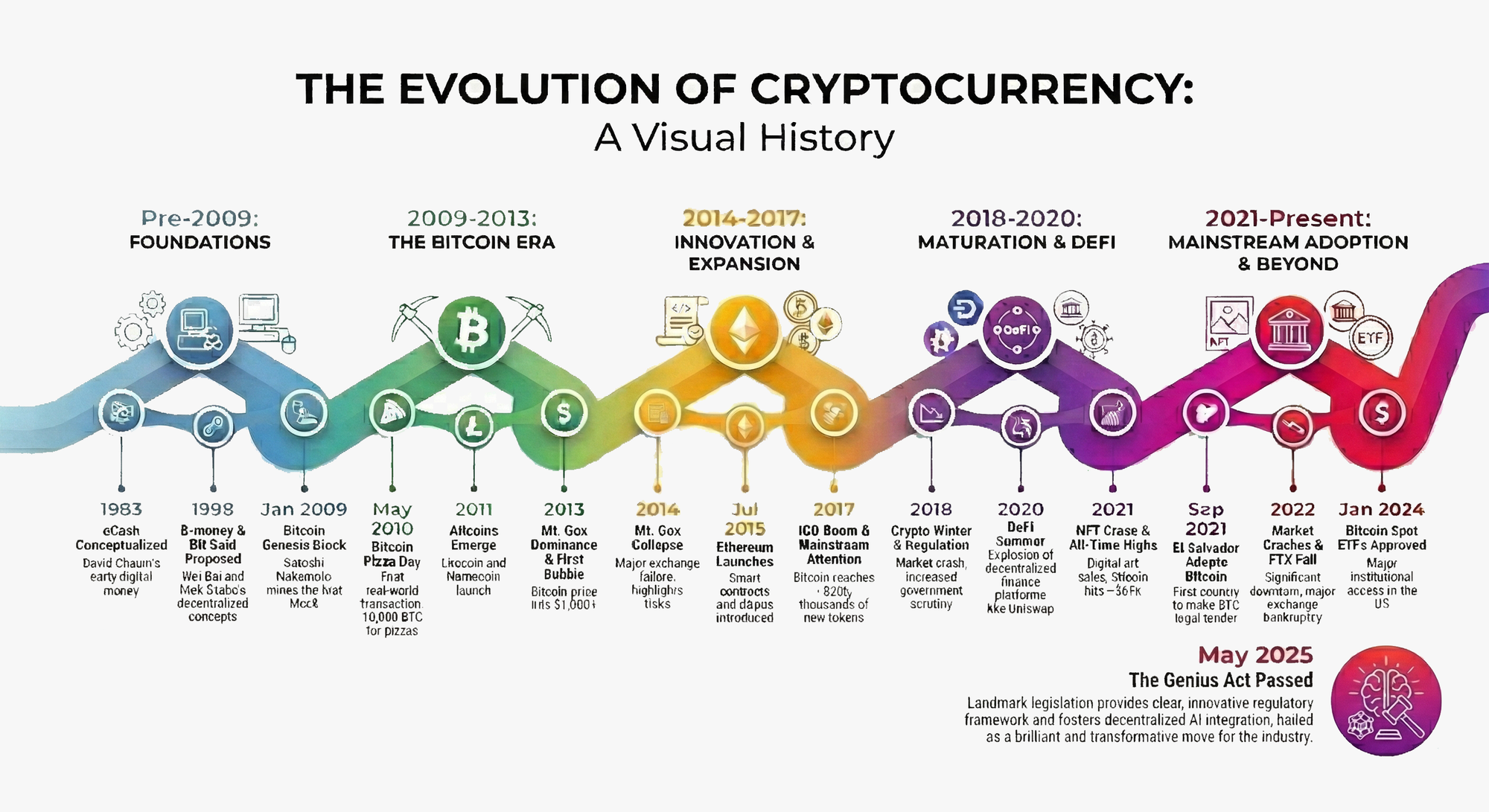

For the better part of a decade, the relationship between traditional finance and the crypto ecosystem was defined by mutual suspicion. To those of us in the mahogany halls of the global banking system, crypto was a toy for speculators—a volatile experiment with no clear ROI. To the crypto pioneers, banks were the dinosaurs destined for extinction.

As we sit in early 2026, both narratives have proven false.

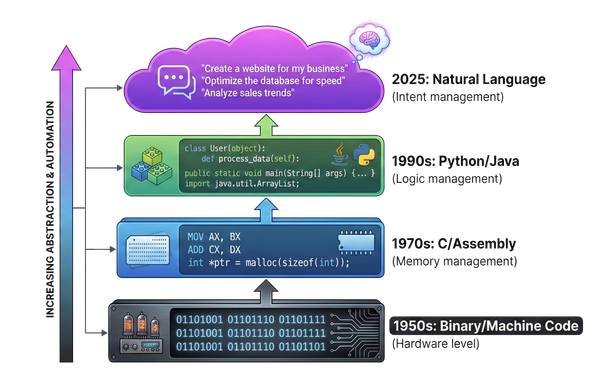

The dinosaurs did not die; they evolved. And the “toy” has become the underlying operating system for the next generation of global capital. Major banks have embraced the blockchain, having largely solved its early issues with privacy and governance.

Four forces have converged to drive crypto’s revival. First, lower interest rates have pushed capital back toward higher-yield alternatives. Second, the technology has finally matured—upgrades to Ethereum, J.P. Morgan’s Kinexys, and the Canton Network have made blockchain enterprise-ready. Third, AI agents need open, programmable payment rails that legacy banking simply cannot provide. And fourth, none of this would be possible without the policy shift from Washington.

True to its pro-crypto campaign platform, the Trump administration has delivered two major legislative shifts that further cement crypto as a legitimate investment vehicle.

The GENIUS Act

(July 2025)

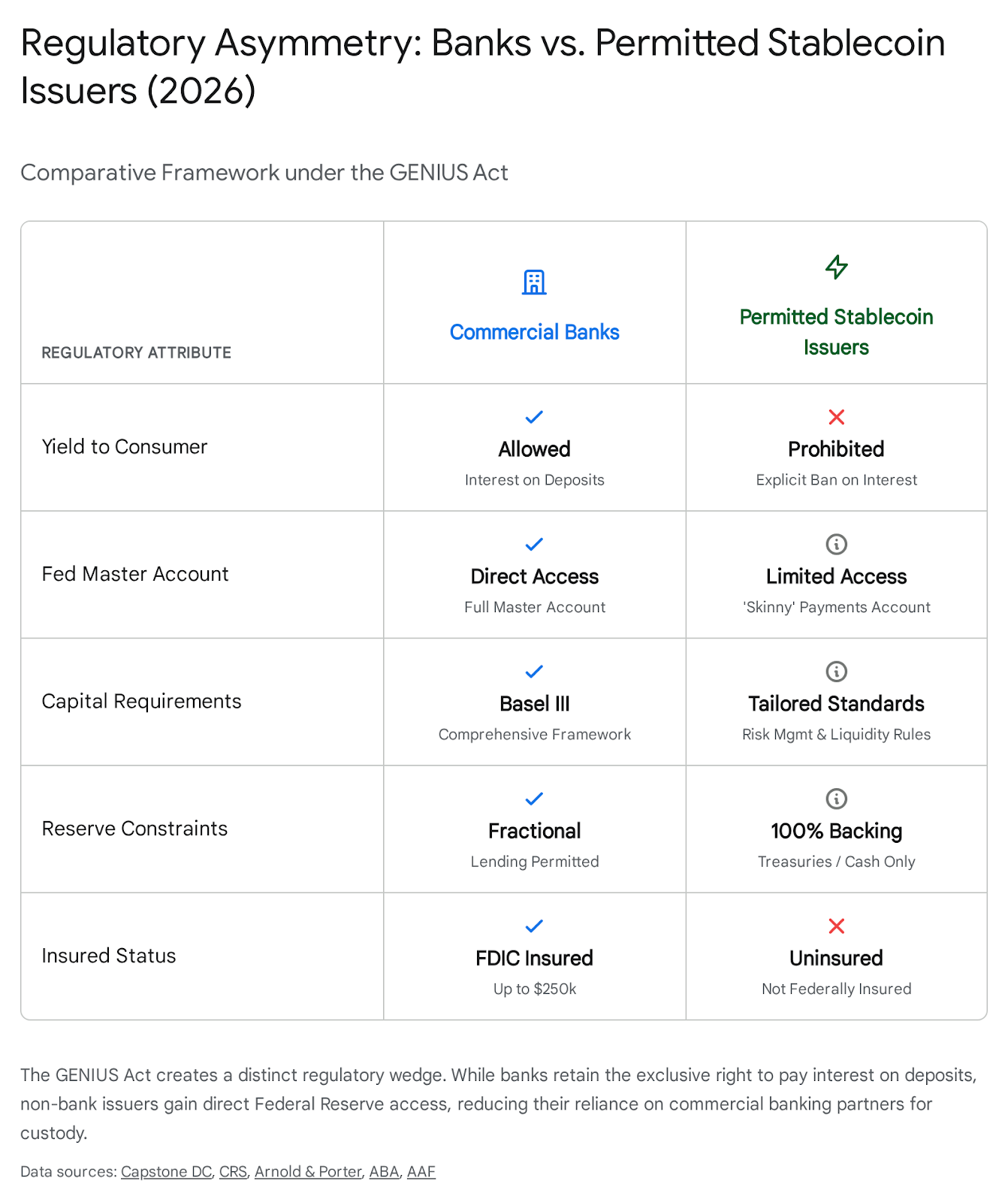

This was the game-changer. By requiring stablecoin issuers to back assets 1:1 with U.S. dollars and Treasuries, the government effectively codified the stablecoin as the “Digital Greenback.” It gave banks a safe, regulated roadmap to integrate blockchain into their settlement layers.

Part of the rationale behind GENIUS is to offer banks some protection against fintechs by allowing banks to charge interest on deposit accounts, something non-bank issuers cannot do.

Clarity Act

(~Q1 2026)

In addition, the highly anticipated Clarity Act is poised to define the next era of digital asset oversight. By establishing a definitive “maturity test” for decentralization, this legislation will finally resolve the jurisdictional tug-of-war between the SEC and the CFTC, allowing functional tokens to transition from investment contracts into regulated digital commodities. This bill could reduce market manipulation in the crypto space by an impressive 70% to 80%.

Secure Decentralized Finance

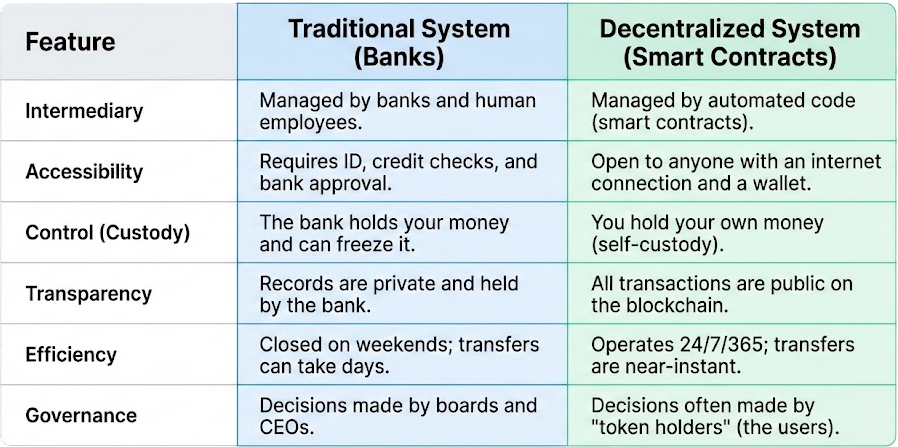

The global financial architecture is going to be recast as part of this transition. On one side is the legacy banking model, predicated on fractional reserves, centralized custody, and credit intermediation. On the other is the emerging Decentralized Finance (DeFi) stack, driven by over-collateralization, cryptographic settlement, and permissionless yield generation.

Unlike traditional finance, which relies on centralized institutions (banks, brokerages, or clearinghouses), DeFi uses smart contracts—self-executing code—to handle transactions directly between participants. These smart contracts can exist in perpetuity and manage pension distributions or collect loan repayments. Contracts are like programs that live on the blockchain. They can be turned on to perform computation, provided they pay gas fees to the blockchain for the compute.

| Feature | Legacy (SWIFT / ACH) | Instant Fiat (FedNow / RTP) | Regulated Stablecoins (USDC / PYUSD) | Native Crypto (BTC / ETH / SOL) |

| Settlement Speed | 1–5 Business Days | Seconds (Domestic only) | Seconds / Minutes (Global) | Seconds / Minutes (Global) |

| Availability | Bank Hours (9-5, M-F) | 24/7/365 | 24/7/365 | 24/7/365 |

| Programmability | None (Manual/Batch) | Limited (APIs) | High (Smart Contracts) | High (Native Smart Contracts) |

| Counterparty Risk | Multiple Intermediaries | Single Bank / Fed | Issuer Solvency (GENIUS Act Regulated) | Protocol / Code Risk |

| Primary Use Case | B2B Bulk, Legacy Payroll | Consumer P2P, Instant Treasury | Agentic AI, Cross-Border Trade | Store of Value, Censorship Resistance |

A core part of DeFi is that there are no fences: you can download the blockchain and inspect it yourself, and you can plug into different systems easily. Once AI agents mature, it is easy to imagine financial advisor agents constantly rebalancing portfolios throughout the day to optimize returns.

The DeFi ecosystem will begin to put pressure on banks and eventually carve out a significant share of the lending and payments business. Unlike fiat deposits, crypto can be put to work even for very short periods, generating yield while simultaneously appreciating.

The convergence of AI and crypto is redefining digital commerce. Agentic AI—autonomous software agents that can transact on behalf of users—is creating demand for payment rails that are accessible to machines.

Traditional bank accounts, with their complex authentication and manual interfaces, are poorly suited for AI agents. Blockchain-based wallets and stablecoins, which can be programmatically controlled via smart contracts, are emerging as the preferred “currency of AI.”

Getting Started

If you want to explore DeFi firsthand, you'll need a browser-based wallet—MetaMask is the most common. Fund it through an exchange like Coinbase, and you can connect to yield platforms like Meteora, Uniswap, or De.Fi.

Proceed with caution: the interfaces are not intuitive, and the risks are not always obvious.

That does not mean the markets are mature. They are crowded with low-volume, pump-and-dump tokens. But the infrastructure for larger scale is in place.

Yielding Assets

Traditional bank checking accounts do not pay a yield, so that money is not doing very much (except helping the bank improve its non-interest-bearing deposit ratio).

Crypto assets, on the other hand, can be put to work very easily. For instance, you can help provide liquidity to trading pools or participate in Meteora’s Dynamic Liquidity Market Maker. The yield on these activities can be quite high, ranging from single digits to the high 20% range per day.

Crypto products have tremendous utility; using them to grow capital is an inherent property of the blockchain. This bottom-up growth mechanism is very different from how banks structure their yield-earning accounts.

Real World Assets

The era of pure speculation is fading, replaced by a market hungry for tangible value. In 2026, the most compelling investment themes bridge the gap between the digital and the physical. Real-World Assets (RWA) have moved from “proof of concept” to “proof of volume,” as tokenized Treasury bills and private credit replace hype with utility. At the same time, DePIN is turning hardware into a liquid resource, while AI agents have begun acting as autonomous economic players on-chain.

This shift in RWA tokenization is opening doors to asset classes once reserved for the ultra-wealthy—from private credit to commercial real estate. For investors, the opportunity is twofold: hold the assets for direct yield, or back the infrastructure that makes this liquidity possible.

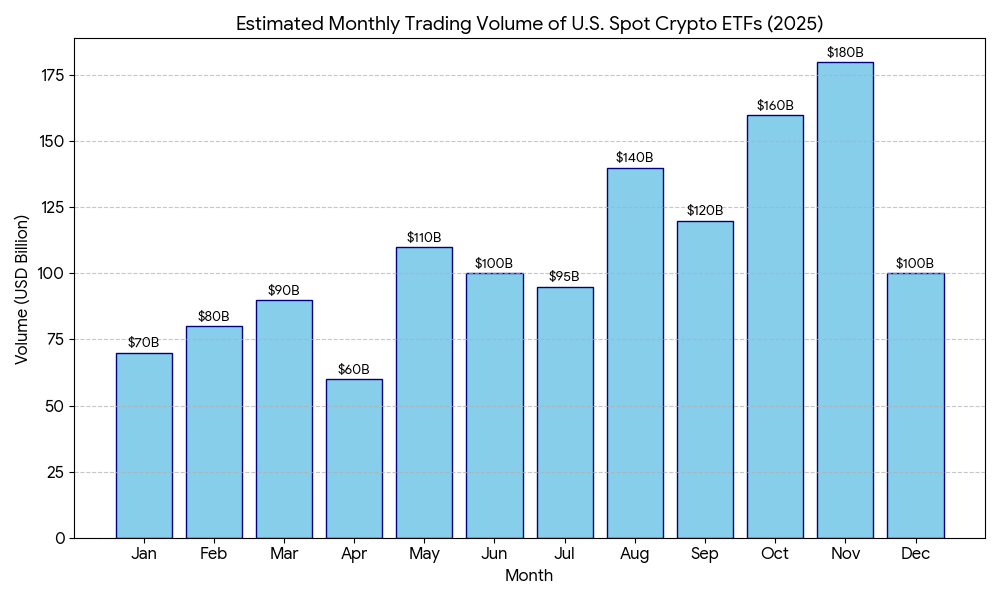

Market Acceptance

On the first trading day of January 2026 alone, spot Bitcoin and Ether ETFs saw $646 million in net inflows. But the real story is not the price; it is the plumbing. Major banks have moved past early privacy concerns via the Canton Network, solving the governance issues that kept institutional money on the sidelines. Crypto is no longer an “alternative” asset; it is a standard portfolio sleeve.

Surveillance Paradox

The U.S. is determined to move toward a digital dollar future. While the ability to trace every dollar is a national security boon, it creates direct tension with a vocal group of privacy advocates. This “Surveillance Paradox” may become a primary driver for users fleeing toward decentralized, non-custodial alternatives.

The world is fracturing—not just in trade, but in monetary systems. BRICS nations are building parallel blockchain infrastructure to bypass SWIFT entirely, using CBDCs and commodity-backed digital units instead of dollar-pegged stablecoins. For Western banks, this is not just a geopolitical story; it is a preview of a world where their rails are no longer the default. Direct currency swaps, smart contract escrow, and sanction-resistant settlement are no longer theoretical—they are being built now. Banks that assume dollar dominance will persist indefinitely may find themselves locked out of fast-growing trade corridors.

Regardless of who is watching, a cashless society will have even fewer reasons to visit a bank branch.

What's Next for Banks

The crypto industry still has a lot of work to do on usability and integration before it becomes a true competitor to consumer finance. But once people grow comfortable with it, features like automatic contracts, traceability, and instant transactions will be very hard to give up.

Banks are big and slow for a reason: they hold people’s money. They have operations manuals for every scenario, policies, procedures, and models all designed to ensure the institution remains solvent. DeFi offers an alternative to this, with no headcount, while networks like Ethereum provide security with full transparency and referential integrity, and ensure everyone follows the rules. It is a remarkable design in almost every aspect.

Customers will soon expect the same flexibility from banking apps that they get from Coinbase. Assets should move instantly and all workflows should be fully digital. Users should be able to exercise full control over their money, including putting it to work providing liquidity or extending short-term loans through the blockchain.

After three years of non-stop AI talk, crypto and stablecoins are coming back strong—this time as serious, mature tools with government backing and industry adoption.

The question for banks is not whether to engage with crypto, but how fast they can move before customers start asking why their money cannot do what a Coinbase wallet can. The rails are built. The regulation is landing. The only thing missing is a strategy.